Fraud Prevention Checklist

Our fraud prevention checklist is here to help you take charge of your online banking security. By following these simple tips, you can better protect yourself from threats like phishing scams and unauthorized access.

Our fraud prevention checklist is here to help you take charge of your online banking security. By following these simple tips, you can better protect yourself from threats like phishing scams and unauthorized access.

United Bank, along with what is reported to be many other organizations across the globe, was recently impacted by a software vulnerability in MOVEit, a third-party file transfer tool. As soon as we learned of the incident, we immediately launched an investigation to assess and mitigate any potential impact of this situation. We take the confidentiality of our customers’ information very seriously and have notified those customers who have been affected and provided additional information and resources to support them. Please call 844.665.7611 for more information.

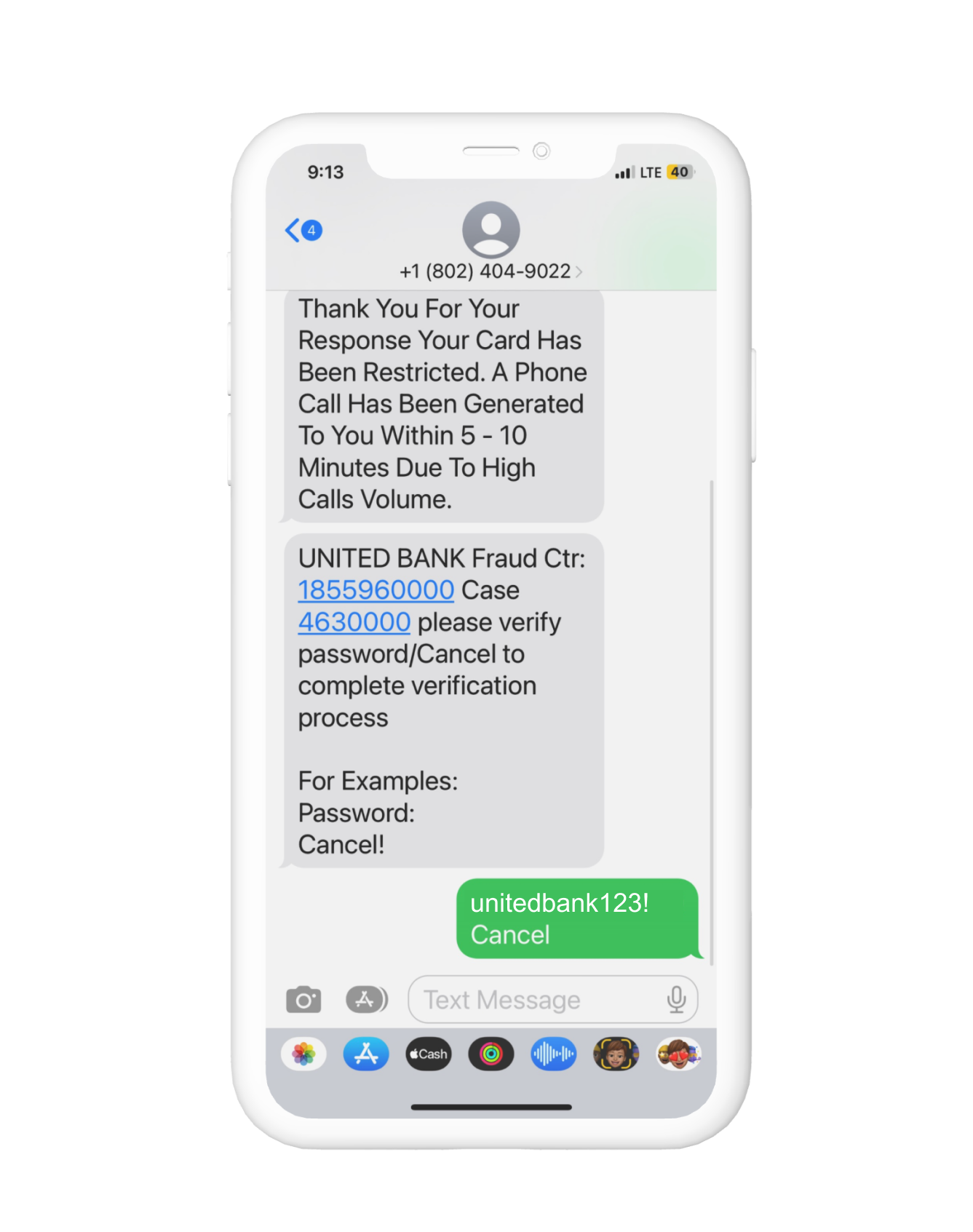

Never release sensitive information over the phone when receiving an unsolicited call or text.

Sensitive information may include full or partial Social Security number, card PIN number, one-time passcodes, online banking user ID, online banking password, or online banking security questions.

Scammers use this information to reset credentials and take over online banking accounts. If you receive an email or text message confirming a change on your account that you did not make, please contact United Bank's Customer Care department immediately.

We will never request personal information, such as your online banking user ID, security codes, or account information, through unsolicited text messages or calls.

Remember:

If you are a victim or if you have further questions or concerns, please call United Bank’s Customer Care immediately at 800.327.9862.

DO NOT use the number on the caller ID screen and hit redial.

If you suspect you have fallen victim to a scam, identity theft, or other fraud schemes, please download our Fraud Victim Guide. This resource provides important steps recommended in accordance with the Federal Trade Commission guidelines.

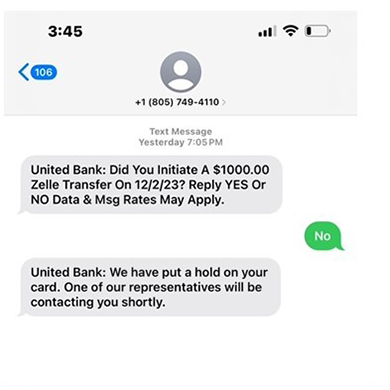

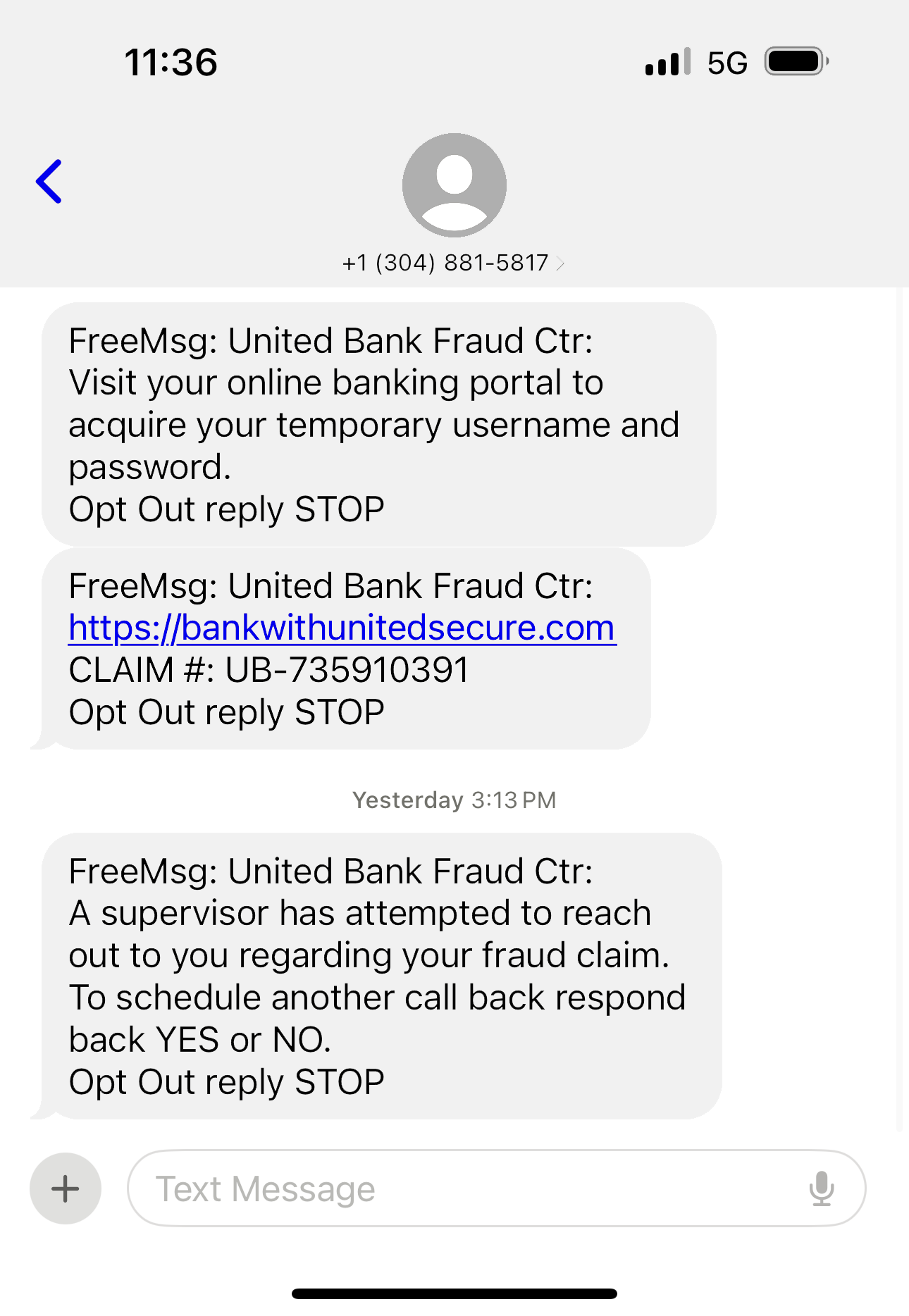

United Bank will not follow-up with a phone call when you respond Yes or No. We will not message you indicating a representative will be contacting you.

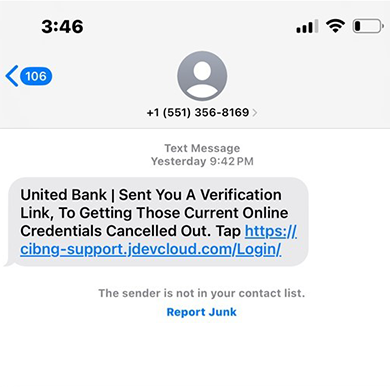

United Bank will never send you a verification link to your phone. Do not click on the link. Call us directly to validate if your online banking credentials were compromised.

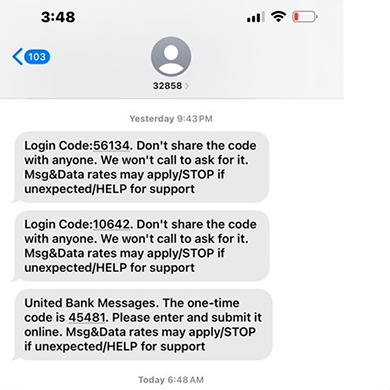

A one-time code will not be referred to as a Login Code. United Bank will not ask you for your one-time security code over the phone or from a text. Only input your official security code from our website when you initiated the request.

Be aware of fraudsters sending you a link that looks like a United Bank link to reset your User ID and Password. Do not click on the link in the text message. Call Customer Care at 800.327.9862 to verify if your account was compromised.

Scammers often pose as legitimate charities to exploit generosity. To ensure your donations go to trustworthy organizations always:

While the holiday season brings joy, it also attracts scammers who try to take advantage of the festive spirit. Here are some red flags to watch out for:

Phishing Emails: Be cautious of unsolicited emails asking for personal or financial information. Verify the source and never click on suspicious links.

Fake Charities: Research charities before donating to ensure your money goes to a legitimate cause.

Gift Card Scams: Scammers may impersonate loved ones asking for gift cards. Always verify such requests directly with the person.

Online Shopping Scams: Shop only from trusted websites. Double-check website URLs and look for secure payment options.

Too Good to Be True Deals: If an offer seems too good to be true, it probably is. Trust your instincts.

Scammers are always creating new ways to steal your money. One of the recent scams utilizing peer-to-peer payment services is what’s known as the “Pay Yourself Scam.” The gist of the scam is that someone pretending to be a representative from United Bank tells you that there has been a fraudulent transaction and in order to stop it, you need to send yourself money with Zelle®.

While United Bank may send you a text alert to prevent unusual activity, we will never contact you to request that you send money using Zelle® to anyone, including yourself, or to share a code to resolve fraud. If you receive a request like this, it is likely a scammer trying to trick you.

Please watch this educational video from Zelle® to learn about the trending scam. If you detect suspicious activity regarding Zelle®, hang up and contact Customer Care, at 800.327.9862.