Business Accounts

United’s Business Edge will be available for login.

We strongly recommend that you log in, validate account access, define user entitlements and become familiar with Business Edge before transitioning to United Bank. Please refer to the “Getting Started” section of your welcome letter.

Beginning the week of March 10, United will host a series of informational webinars to demonstrate the features and functions of Business Edge.

The Preview Period for United’s Business Edge will be available until 3:00 p.m.

Piedmont Business Online Banking will be available until 5:00 p.m.

- Beginning at 9:00 a.m., you will be able to access your live account information through United’s Business Edge. Should you need any assistance, please contact United Bank Treasury Management Operations at 800.615.0112, Option 2, or TreasuryManagement@BankWithUnited.com.

- Business Online Banking

- Business Mobile Banking

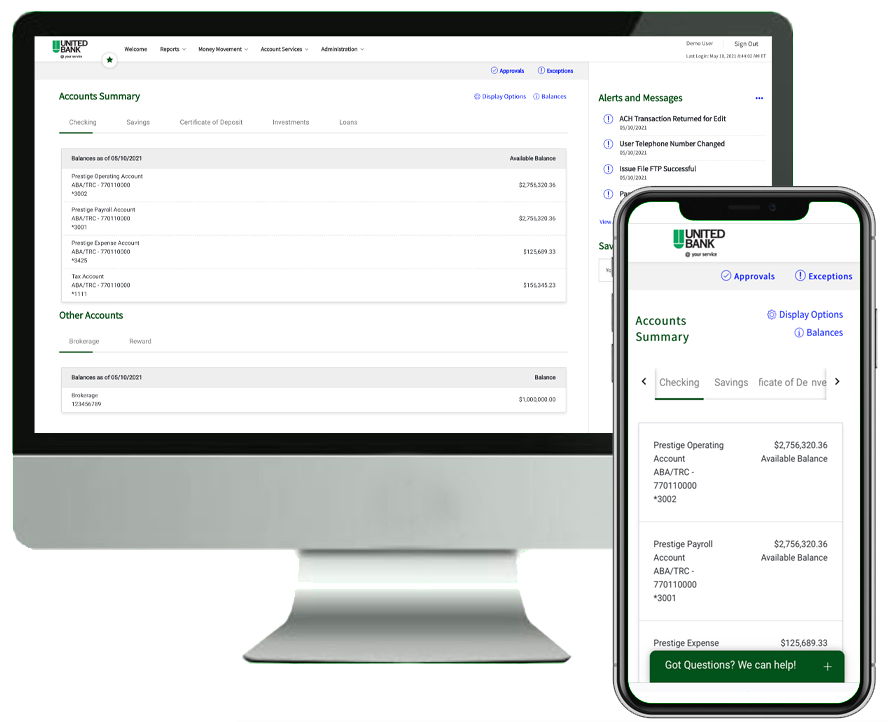

Business Edge

Business Online Banking will automatically convert to United Business Edge on the Monday post-transition. Administrators will receive a separate mailing with detailed information on United Business Edge. View Letter

For your convenience, you have access to user guides and a webinar series to help you get started. You will also have access to an Administration Reference Guide to assist you with adding, modifying, and deleting users and their access to your company’s accounts.

Webinar Series

| Date | Time | Webinar Link |

|---|---|---|

| Tuesday, March 25 | 10:00 a.m. | Access Webinar |

View a Pre-recorded Session

How to Access United Business Edge

- Beginning on the Monday post-transition, visit the Homepage or the Business Homepage.

- Choose Business from the secure sign-in box.

- Enter your Company ID. A seven-digit Company ID number, which is required at login, will be mailed to Administrators separately.

Enter your User ID, which is the same as your current Piedmont Bank Online Banking User ID; however, the User ID for United Business Edge is alphanumeric only and will exclude spaces and special characters such as commas and underscores. If your User ID currently contains spaces and/or special characters, these will be removed. - Click Sign In.

- Enter your temporary password. The temporary password for your first login will be “United1” plus the first three letters of your User ID.

- Once logged in, you will be routed to the Business Edge welcome page, where you will see the same account information as you did with Piedmont Bank.

Managing your business funds while on the go has never been easier. For your convenience, United offers a business mobile app, Bank With United Business.

- Funds Transfers

- Balance & Transaction Inquiry

- Bill Pay with Payee Management

- Mobile Deposit*

- Check-Image Viewing

- Wire, ACH and Positive Pay Approvals+

Download the Bank With United Business app in the Apple App Store or on Google™ Play.

Remote Deposit

United will convert Piedmont Bank Remote Deposit customers to an improved Remote Deposit Service.

Piedmont Remote Deposit Capture customers can continue to use the same scanning equipment with the same login information you currently use until the close of business on Friday, March 21.

On Saturday, March 22, Piedmont Bank Remote Deposit will become United Bank Direct Link Merchant. Each user will receive a communication with detailed instructions on how to download Webscan and update scanner drivers, as well as provide you with login credentials effective on Monday, March 24.

Log In to United’s Remote Deposit Beginning March 24

Beginning the week of March 3, you will receive an email from United Bank providing details and instructions for your conversion to United Bank’s Remote Deposit Capture platform, Direct Link Merchant.

Beginning the week of March 3, United Bank will begin issuing user’s new login credentials. All credentials will be issued by March 20th. If you have any questions, contact a Treasury Management Specialist at 800.615.0112 or email United Bank’s Direct Link Merchant specialist at RemoteDepositCapture@BankWithUnited.com.

Once you are converted to United Bank’s Direct Link Merchant, you will enjoy the following features:

- Ability to view transaction history and images of checks

- Access to many reports, including the following: Deposit Detail Report ▪ Deposit Summary Report ▪ Deposit Image Report

- Ability to generate reports in multiple formats (PDF, CSV, etc.)

- Deposit processing until 8 p.m.

Other Business Services

- Your merchant processing and third-party payroll processing will not change.

- All sweep account relationships, including zero balance accounts (ZBAs), will remain the same with no changes in fees.

Automatic Deposits and Payments (ACH)

Any direct deposits or automatic payments on your current account will continue automatically. No action is needed on your part. When establishing a new direct deposit or automatic payment after the transition, please use the United routing number: 056004445.

Important Notice

FDIC Insurance: In Georgia, branches operating under the United Bankshares name are in fact United Bank branches. It is important for you to know that United Bank is one bank regardless of whether you maintain your account at a United Bank branch outside of Georgia or at a United Bankshares branch within Georgia. Specifically, for purposes of your FDIC insurance coverage, United Bank and its United Bankshares branches in Georgia are viewed together as a single bank. If you hold one or more accounts maintained at a United Bank branch outside of Georgia and you also hold one or more accounts maintained at a United Bankshares branch within Georgia, all of these accounts are seen as being held at a single bank and are restricted to the standard insurance amount of $250,000 per depositor, per insured bank, for each account ownership category. All deposits will continue to be FDIC-insured up to the maximum amount allowed. In addition, for six months after the transition, your accounts with Piedmont Bank will be insured separately from any you may have with United.

For more information on FDIC insurance, please call 877.ASK.FDIC.